Mortgage for Self-Employed, A home mortgage is the most popular way to purchase a home, but it’s also one of the most difficult types of financing to obtain on your own, especially if you are self-employed. Luckily, if you follow these three steps, you can be on your way to getting a mortgage when you’re self-employed in no time at all!

1) How much can you afford?

When you’re self-employed, it can be tough to predict your income from month to month. This makes it hard to know how much you can afford to spend on a mortgage.

The best way to figure this out is by looking at your average monthly income over the past year. If you have fluctuating income, look at your highest-earning months and use that number. Add up all your debts, including credit cards, car payments, student loans, etc. Then subtract that number from your monthly income.

ALSO READ: Which One Is Right for You? Mortgage vs. Deed of Trust

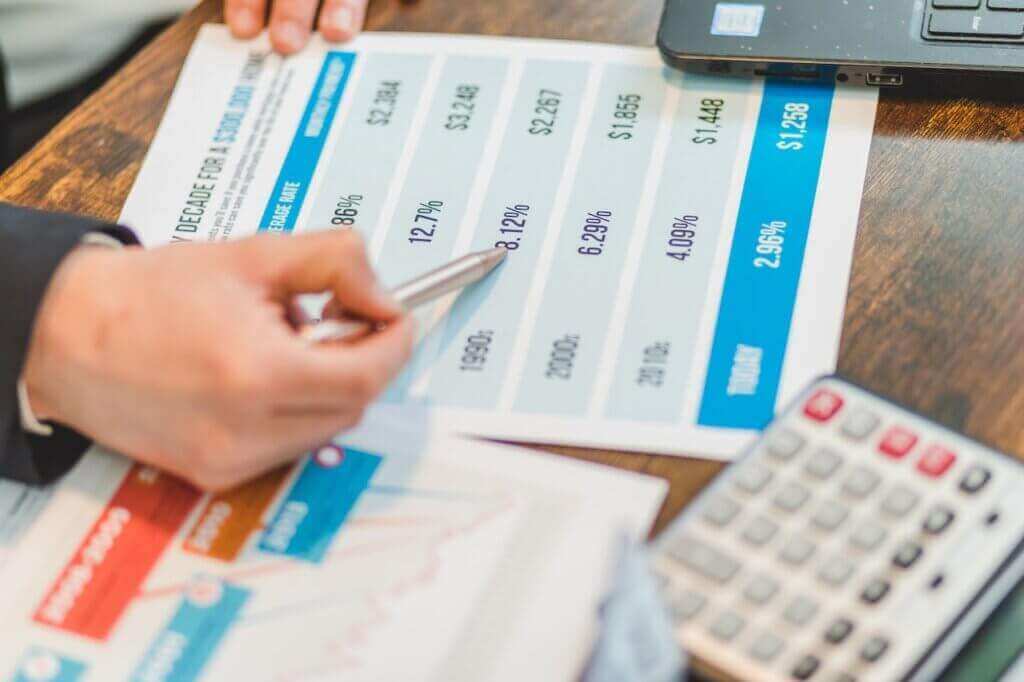

This will give you an idea of how much budget room you have to afford a mortgage payment. Remember, lenders want you to pay 30% or less of your gross monthly income for housing expenses. So if you make $4,000 per month and have $2,000 in debt total ($1,000 per month), then a mortgage payment should cost no more than $1,200 (30% of $4,000).

One way to find out how much your house will cost is to check your mortgage provider’s website, and to choose your price range for a house and an area in which you’re interested Also read ( How to Calculate Your Annual Income ). It’s important to note which lender offers mortgages for people with bad credit, so don’t forget to check their listings as well!

I recommend checking out my blog post, What Type of Home Can I Afford? when figuring out what type of home you would like to buy.

2) Get proof of income and pay stubs

If you’re self-employed, there are a few extra steps you’ll need to take to get approved for a mortgage. First, you’ll need to get proof of income and pay stubs. The best way to do this is by providing tax returns from the past two years.

If you don’t have tax returns, you can provide bank statements or 1099 forms. Once you have your documentation in order, it’s time to start shopping around for a lender who specializes in loans for self-employed borrowers. We recommend using LendingTree to find lenders in your area.

3) Show your stability with savings accounts

As a self-employed individual, you likely don’t have the same steady income as someone who is employed by someone else. Lenders like to see stability, so one way to show them that you’re a responsible borrower is by having multiple savings accounts.

ALSO READ: Budgeting and Money Management

This demonstrates that you can save money and plan for the future. Plus, if you have money saved up, it shows that you’re less likely to default on your loan. If you need help managing your finances, look into online banking tools or ask a trusted friend or family member to act as a co-signer.